Status: AVAILABLE (can be requested at any time of the year)

Recipients: People with rent debts due to unforeseen circumstances

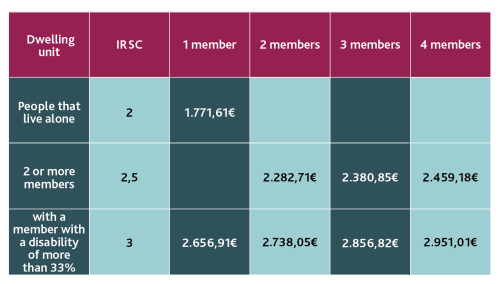

Family income limit: Between 2 and 3 times the IRSC*, depending on the members of the household

Maximum monthly rent: 900 €

Administration that grants the aid: Housing Agency of Catalonia

Details of the aid

Aid for the payment of rent debts

This aid helps people with financial difficulties to manage the payment of rent. The aims of this aid are to:

- Prevent eviction as a result of rent non-payment, allowing the applicant and his/her household to remain in their home.

- Prevent social exclusion as a consequence of the loss of housing.

If the applicant leaves or loses the home through legal channels during the processing of the application, the aid will be denied as the home will cease to be his/her habitual and permanent residence. In cases in which the home is lost as a result of a legal proceeding, aid for the loss of housing can be requested.

For the purpose of these benefits, the following concepts are considered to be part of the rental amount: rent, rent arrears, amounts corresponding to the impact of improvement works, real estate tax ( IBI), the fee for the garbage collection service and, where applicable, the garage and storage costs included in the contract and paid by the lessee.

Related links

What do you need to know to apply for aid?

In these sections, you can find out the eligibility requirements and the steps you need to follow to apply for this aid, which can be requested at any time from the Housing Offices of Barcelona.

Beneficiaries

Persons residing in Catalonia, whose household income does not exceed the limits established in the requirements, and who have generated a rent debt and are at risk of residential social exclusion.

Eligibility requirements

Beneficiaries must meet the following requirements:

- Monthly household income cannot exceed the amounts indicated in the table.

- The home must be the habitual and permanent residence of the applicant, and must constitute his/her domicile according to the municipal register.

- This same criterion applies to the relationship between the property owner and the tenant, when the former is a legal entity, with respect to its members and participants.

- The urgency and the special need of the household must be proven with the contribution of a socio-economic report from Social Services of primary or specialised care, which proposes the granting of the aid for these reasons.

- The applicant must hold a rental contract, an assignment of use or, exceptionally, a sublet contract as regulated in article 8.2 of Law 29/1994, of 24 November on urban rentals, or the right of subrogation over the home, in accordance with articles 15 and 16 of Law 29/1994 and other concordant provisions.

- The applicant must have generated a rent debt due to unforeseen and unexpected circumstances, duly justified.

- The applicant must have paid the rent for a minimum period of six months, counted from the signing of the rental contract until the submission date of the application for the aid.

- The amount of aid requested must guarantee the settlement of the existing debt and the applicant must be in a position to continue paying the rent from the moment the application is submitted. This condition is considered to be met when the monthly household income is at least equal to the monthly rent payment.

- If, while processing the application, debt continues to accumulate, social services can propose an increase of the requested amount, justifying this request through a new social report. The proposed increase will be assessed and, if appropriate, may be resolved favourably, always within the limits of the maximum amounts established.

- Exceptionally, when the accumulated debt exceeds the established limits, and when documented evidence is provided to prove that an agreement has been reached between the applicant and the property owner or manager regarding the payment of the debt, the request may be evaluated and resolved favourably.

- When the amount of aid granted is less than the maximum amount established, additional aid may be newly granted up to this maximum amount, provided that at least three monthly rent payments are made between the date of the last monthly payment of the aid initially granted and the submission date of the new application, both included.

- Monthly rent cannot exceed 900 euros.

- At the time when the application is resolved, 12 or more months must remain in the term of the rental contract, and if this is not the case, the property owner must guarantee in writing the contract renewal.

- Neither the applicant nor any member of the household can own a home unless they do not have the right to its use and enjoyment.

- Persons who have received the maximum amount of the aid cannot request aid of an urgent and special nature for the payment of the rent until a minimum of one year has passed between the date of application resolution and the new application.

- The aid cannot be received by households in which any member is related by marriage or other similar stable relationship, by consanguinity, adoption or affinity, up to the second degree, with the property owner or manager.

- All persons who are granted payment assistance for rental debt may apply for a continuation grant if they meet any of the following specific requirements: judicial procedure for non-payment of rental income and victims of violence against genre.

- The duration of the continuity grant is 12 months, renewable for 24 more months

Specific requirements for the supplementary aid for payment of rent in case of legal proceedings:

- The beneficiaries of the complementary aid for the payment of rent debts subject to a legal eviction process may be granted complementary aid to continue payment of the rent, provided that at least 12 months remain in the term of the rental contract at the time that the resolution to grant the supplementary aid has been issued. Otherwise, the property owner or manager must guarantee in writing the contract renewal.

- The beneficiaries of the complementary aid for continued payment of rent must be paying the rent by bank transfer, direct debit, account deposit or receipt issued by the property manager at the time of the resolution to grant the aid.

- They will also be able to access the grants:

- Cases with Gender Violence

- Favorable Table Resolutions, no allotted housing from any emergency table

- Expiration of the contract term

Documentation

- Application form for aid of special urgency .

- Original and photocopy or certified photocopy of the identity card (DNI) or foreigner’s identity number (NIE) of the applicant and of all members of the household. If any member of the household does not have a DNI / NIE, an equivalent identification document must be presented. Newly arrived persons who have obtained a DNI must include the NIE that they had before the DNI on the application.

- Certificate of cohabitation proving that the home is the habitual residence of all people in the household.

- Certified photocopy of the family record book, if applicable.

- Socioeconomic report issued by municipal social services of primary or specialised social care, regarding the situation of the household.

- Proof of income of the applicant and of each member of the household that is of working age. Income must be accredited as follows:

- Original and photocopy or certified photocopy of the last three payrolls prior to the presentation of the application.

- In the case of unemployed persons, the certificate/s from the employment office with the amount received during the last three months prior to the presentation of the application.

- In the case of pensioners, the certificate/s issued by the paying body or bodies of the amount to be received for the current year.

- In the case of self-employed workers, original and photocopy or certified photocopy of the last quarterly tax (IRPF) declaration.

- In case of not having an income accredited with official documentation, a sworn statement of income by the payer.

- Working life report issued by the Treasury of Social Security for the applicant and all persons of working age in the household. This report must be ordered via the Social Security website or by telephone 901 502 050.

- Original and photocopy or certified photocopy of the rental contract in the name of the applicant.

- In the event that the person applying for the aid is the spouse of the contract holder, or has been transferred the rental contract, or is in a situation of separation or divorce, the right of use of the home must be proven by providing the subrogation, judicial sentence or, if applicable, separation or divorce agreement.

- With the aid, the entire debt must be settled; however, if an agreement is reached with the property owner to split the debt amount for the assessment of the granting of the aid, the aforementioned agreement must be presented.

- Standardised certificate from the property owner or manager indicating the debt details and the months to which the debt corresponds.

- If an eviction process has begun: certified photocopies of all available legal documentation of the eviction case, proof of having requested a lawyer ex officio or the appointment thereof, and a commitment document signed by the property owner.

- Receipts for rent paid must be presented, in accordance with regulations, in order to collect the aid.

- Standardised bank data form, in the name of the applicant, with the bank account data required in order to make the payment, duly stamped by the financial entity. In order to avoid going to the financial institution, a document certifying the bank account can be provided.

Obtaining data electronically:

When the applicant and the members of the household authorise the managing body to obtain the data necessary for the processing and assessment of the application, it is not necessary to submit the following documentation:

- Certificate of cohabitation that certifies the residence in the home of all people in the household.

- Identity document (DNI), TIE or European Union Citizen Registry Certificate of the applicant and of all members of the household.

- Tax (IRPF) declaration of the applicant and of all people of working age in the household.

- Certificate of payments, in the case of unemployed persons and pensioners.

- Certificate of the degree of disability, if applicable or of reduced mobility that exceeds the degree of 33% of any of the members of the family unit or certificates of people with great dependency.

- Single parent or large family card, if applicable

The Housing Agency of Catalonia may request, directly or through the entities collaborating in the management of these benefits, additional documentation to complete their knowledge of the application submitted.

Amount and application period

- Aid for the payment of rent debts: the amount is determined according to the accredited debt. The maximum limit is 4.500 euros and can be granted for a maximum period of 12 months.

- Supplementary aid for rent payment in case of legal proceedings: The amount of the aid is set at 60% of the annual rent of the home, with a maximum limit of 2,400 euros per home. This aid can only be granted once and for a maximum period of 12 months.

- This aid can be requested at any time.

Incompatibilities

This aid is incompatible with the following lines of aid:

- Maintenance of the basic income for emancipation, obtained in accordance with Royal Decree 1472/2007, of November 2.

- Aid for the payment of the rent as provided by Law 18/2007, of 28 December, of the right to housing, when the object is the same monthly payment. When the aid is applied to different monthly payments, the sum of the amounts to be received in the same calendar year cannot exceed 4.500 euros.

- Obtaining subventions for the payment of rent as provided by the Agreement of 22 July 2014, between the Ministry of Development and the Government of Catalonia for the execution of aid lines 2013-2016.

- The same applicant can be granted aid for the payment of rent debts and aid for cases of eviction and the complementary aid for the deposit and payment of a new rented home in the same calendar year, provided that the sum of the different benefits does not exceed the maximum amount of 4.500 euros.

- The granting of this aid does not prevent a non-profit organisation, which has signed an agreement with the Housing Agency, from granting temporary aid to the applicant in advance, with the same purpose. The granting of this aid does not presuppose approval of the aid by the Housing Agency of Catalonia.

- These benefits are compatible with aid from other public administrations for the same purpose, provided that the sum of the different benefits granted does not exceed the amount of 4.500 euros and that they have not been obtained for the same year and for the same monthly payments.

Additional information

Given that this aid is a public subsidy and involves capital income, the beneficiary is obliged to present their personal income tax declaration (IRPF), which must include the amount received.

Payment of the aid will be made through a financial institution.

The aid can be paid directly to the beneficiary or, if it is expressly authorised, to the person who provides a guardianship or mediation service, in favour of which this right may be granted.

More information can be obtained from the website of the Government of Catalonia.